NOTES TO

FINANCIAL STATEMENTS

December 31, 2015

38

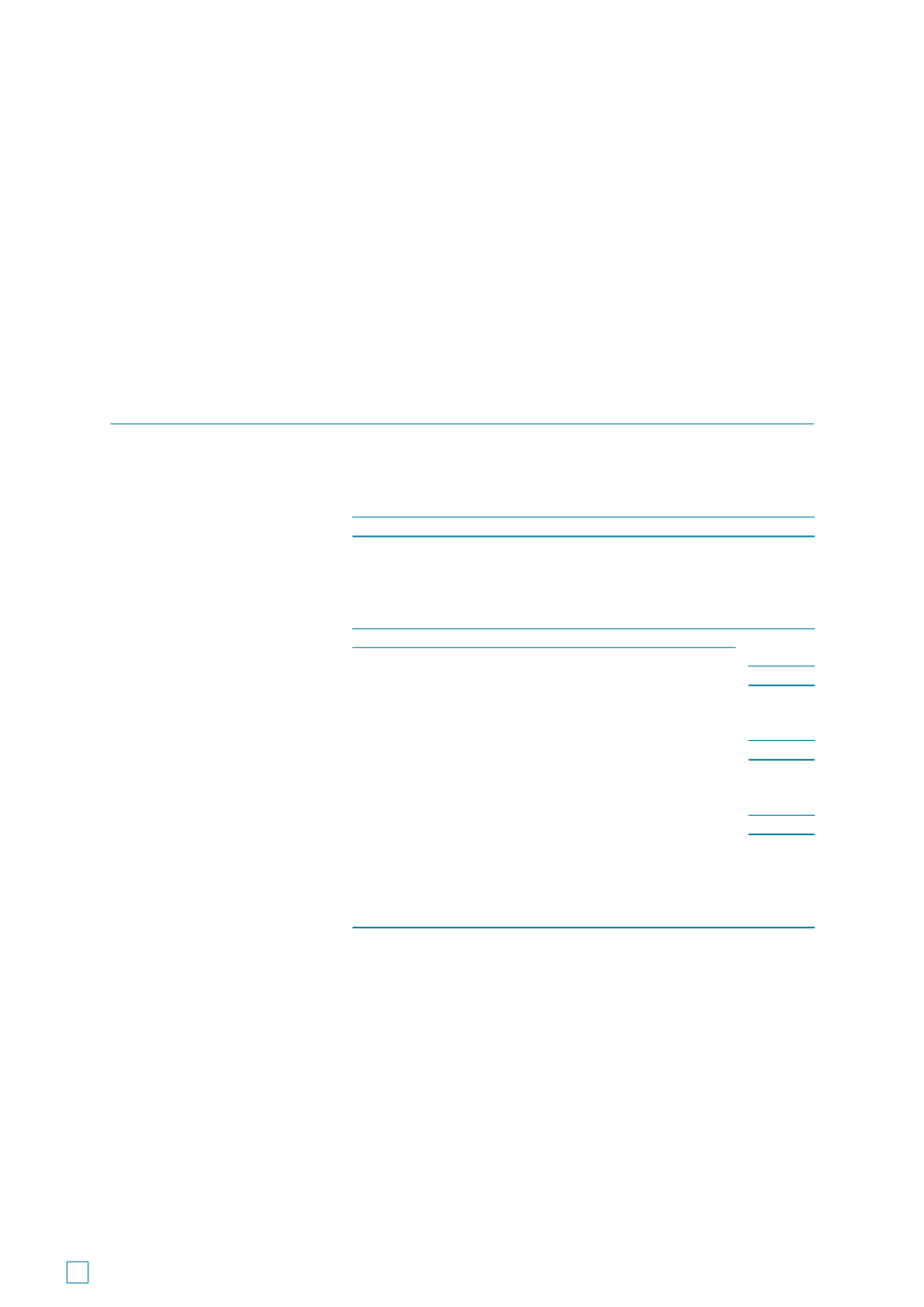

SEGMENT INFORMATION (CONT’D)

The Group’s risks and rates of return are affected predominantly by differences in the services rendered.

Management monitors the operating results of its operating divisions separately for the purpose of making

decisions about resource allocation and performance assessment.

Container

Bulk

Shipping and Tanker

Others Eliminations

Group

US$’000 US$’000 US$’000

US$’000 US$’000

2015

Revenue

– External customers

269,335

43,103

5,238

–

317,676

– Inter-segment

925

18

2,168

(3,111)

-

270,260

43,121

7,406

(3,111)

317,676

Segment results

14,385

(8,352)

1,307

(1,503)

5,837

Finance income

143

274

74

(141)

350

Finance costs

(1,585)

(782)

(4)

141

(2,230)

Share of results of associate

–

1,248

–

–

1,248

Profit before tax

12,943

(7,612)

1,377

(1,503)

5,205

Income tax expense

(1,092)

Profit after tax

4,113

Segment assets

213,286

172,807

13,852

–

399,945

Unallocated assets

29

399,974

Segment liabilities

(80,674)

(60,635)

(4,819)

–

(146,128)

Unallocated liabilities

(1,807)

(147,935)

Capital expenditure

1,748

3,969

90

–

5,807

Depreciation

11,352

12,720

100

69

24,241

Impairment of vessels

6,228

7,511

–

–

13,739

Allowance for doubtful trade debts

368

–

17

–

385

136

FOCUSED & RESILIENT

SAMUDERA SHIPPING LINE LTD

ANNUAL REPORT 2015