NOTES TO

FINANCIAL STATEMENTS

December 31, 2015

31

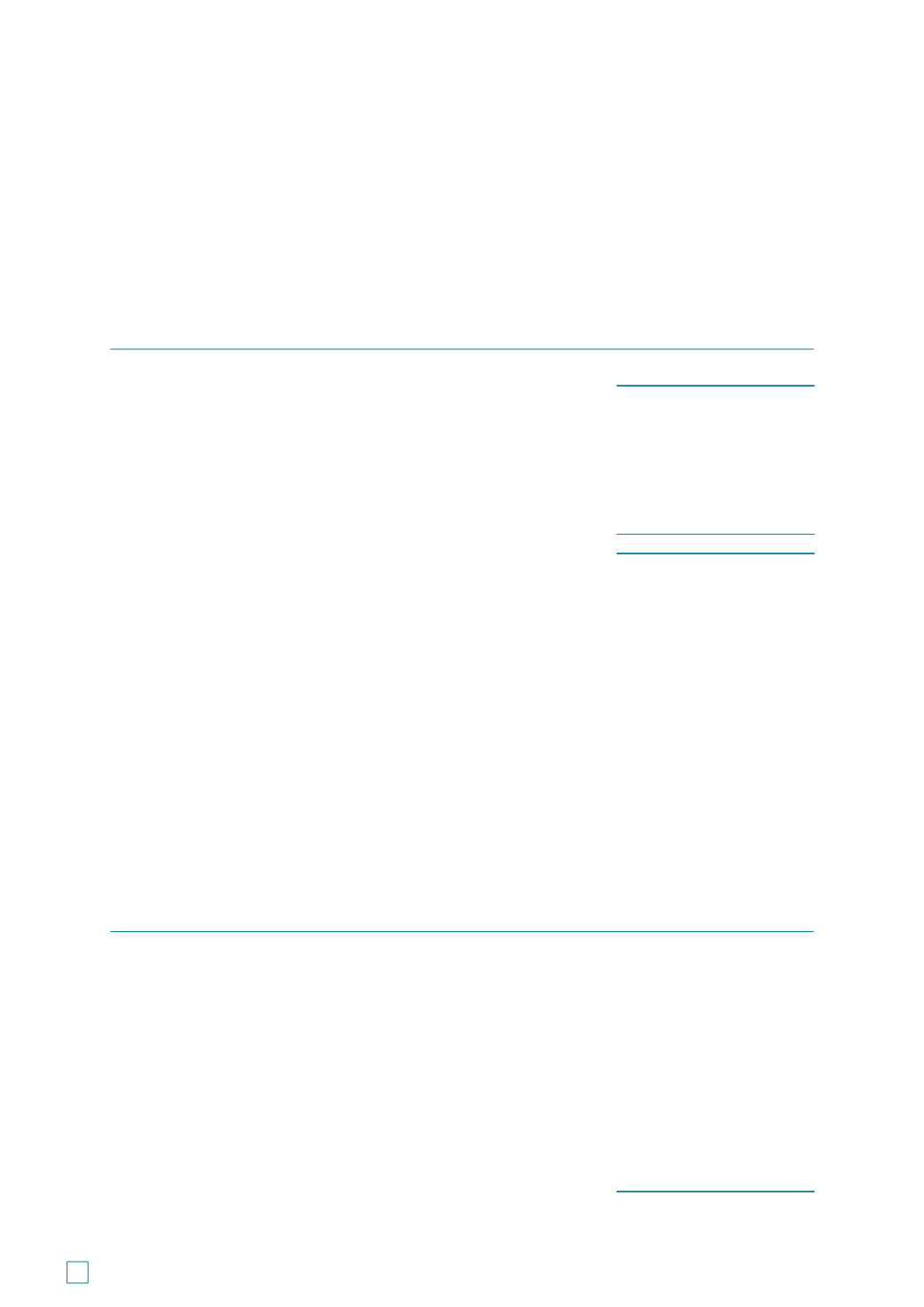

INCOME TAX EXPENSE (CONT’D)

The tax charge for the year can be reconciled to the accounting profit as follows:

Group

2015

2014

US$’000

US$’000

Profit before tax

5,205

16,443

Income tax expense calculated at 17% (2014 : 17%)

885

2,796

Effect of income that is not taxable/deductible

in determining taxable profit

(1,591)

(2,830)

Effect of different tax rates for foreign subsidiaries and associate

816

816

Effect of tax losses disallowed

788

1,087

(Over) Under provision in respect of prior years

(5)

173

Others

199

(120)

1,092

1,922

As at the end of the reporting period, the Group and the Company have tax losses of approximately US$287,000

(2014 : US$287,000) and US$Nil (2014 : US$Nil) respectively that are available for offset against future taxable

profits of the companies in the Group and the Company in which the losses arose, for which no deferred tax

asset is recognised due to uncertainty of recoverability. The use of these tax losses is subject to the agreement

of the tax authorities and compliance with certain provisions of the tax legislation of the respective countries

in which the companies operate.

At the end of the reporting period, the aggregate amount of temporary differences associated with

undistributed earnings of subsidiaries for which deferred tax liabilities have not been recognised is US$34.4

million (2014 : US$51.5 million). No liability has been recognised in respect of these differences because the

Group is in a position to control the timing of the reversal of the temporary differences and it is probable that

such differences will not reverse in the foreseeable future.

32

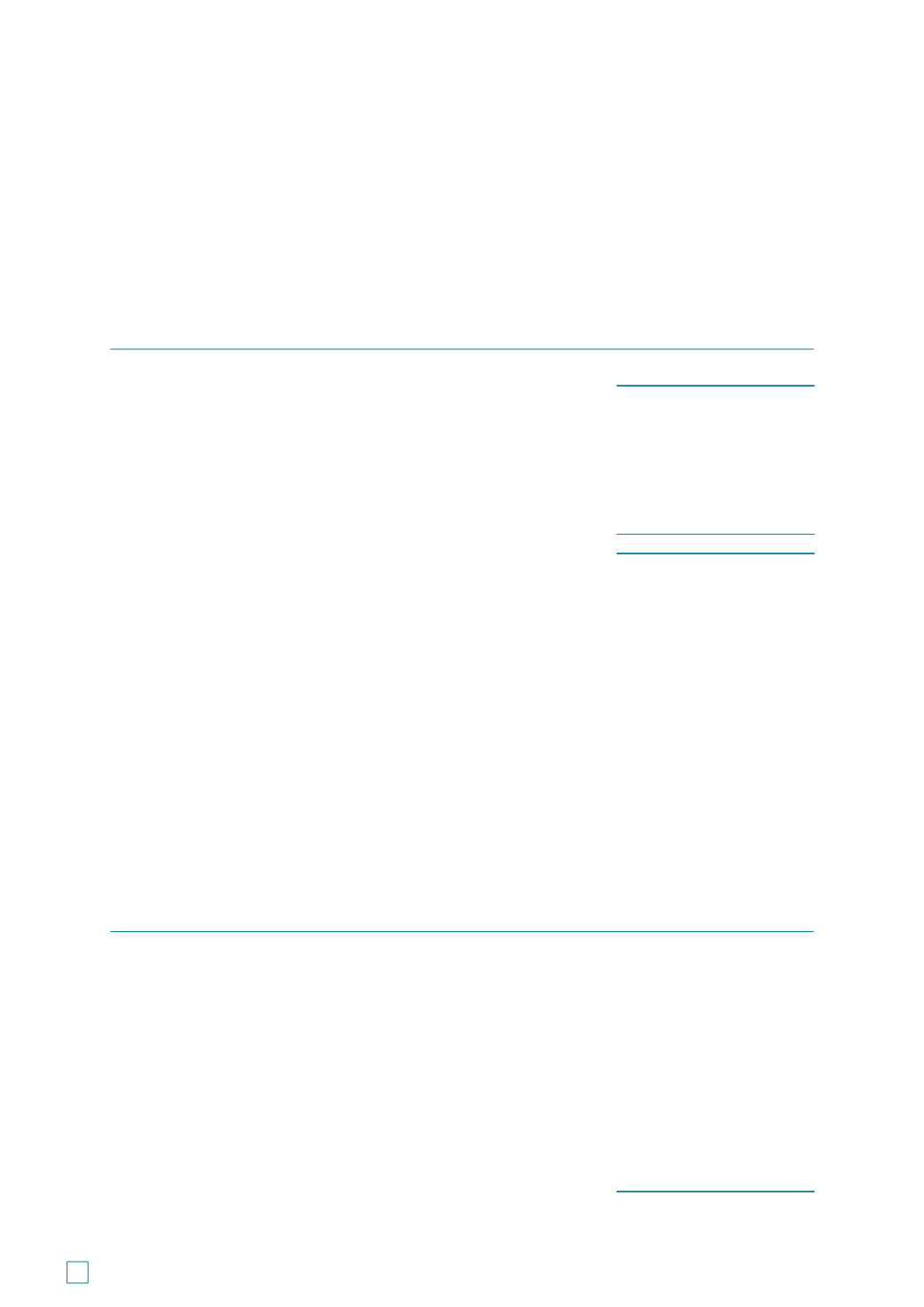

PROFIT FOR THE YEAR

Profit for the year has been arrived at after charging (crediting):

Group

2015

2014

US$’000

US$’000

Operating lease expenses (included in cost of sales)

8,319

8,617

Directors’ fees

137

146

Audit fee:

Auditors of the Company

158

156

Other auditors

58

65

Non-audit fee:

Auditors of the Company

14

15

Other auditors

11

5

Depreciation of property, plant and equipment

24,241

23,810

Depreciation of investment property

26

25

Allowance for doubtful trade debts

385

607

Write-off of amount due from related company

388

–

Write-back of doubtful trade debts

(166)

(297)

130

FOCUSED & RESILIENT

SAMUDERA SHIPPING LINE LTD

ANNUAL REPORT 2015